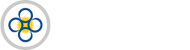

LONDON, Sept 11 (Reuters) - The U.S. Federal Reserve is an outlier among central banks in developed markets, as it looks set to resume rate cuts just as many of its peers are reaching the end of their easing cycles.

The European Central Bank (ECB) left rates unchanged on Thursday, while Japan is expected to hike rates before the year is out.

Here's where 10 major central banks stand:

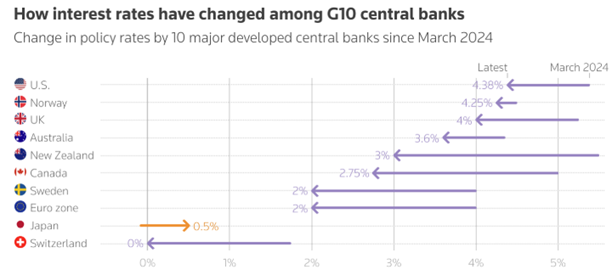

1/ SWITZERLAND

The Swiss National Bank meets on September 25. After it cut its key rate to 0% in June, investors have pondered whether a return to negative territory is likely.

Chairman Martin Schlegel said this week that the bar is high but he does rule out such a move. Inflation holding above the bottom of the SNB's 0-2% target band in August means traders do not anticipate negative rates at the current time.

A line chart comparing inflation metrics over the past five years.

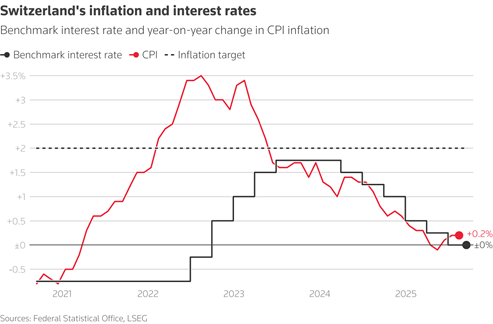

2/ CANADA

A weak economy due to U.S. tariffs, unemployment at a four-year high and lower inflation put pressure on the Bank of Canada to resume rate cuts next Wednesday.

The BoC has cut rates by 225 basis points (bps) since June 2024 but held steady since March. Markets price in roughly two more 25 bp rate cuts by January.

A line chart comparing inflation metrics over the past five years.

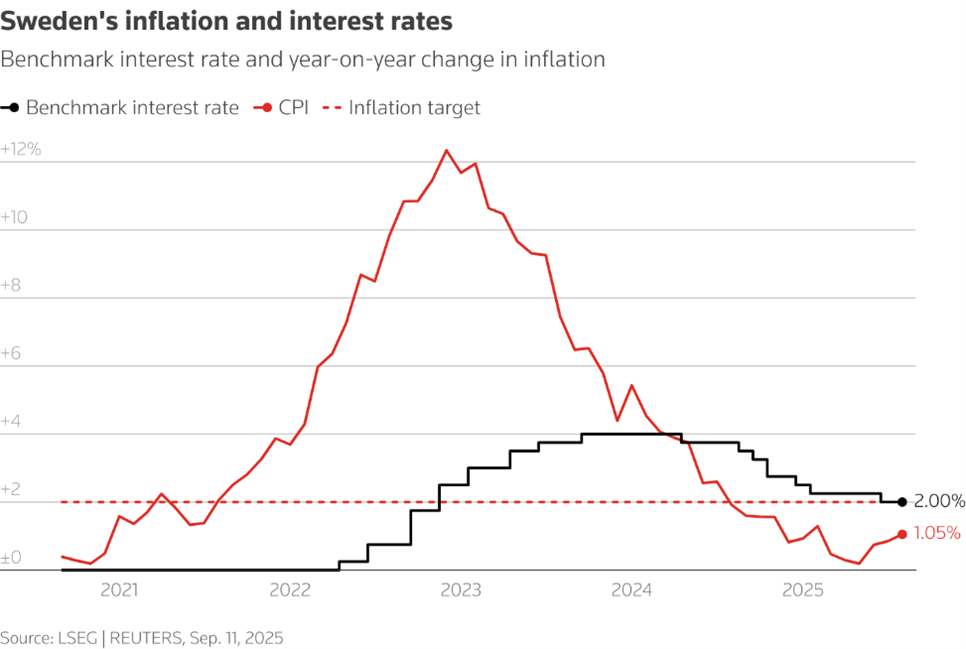

3/ SWEDEN

Sweden's Riksbank has also cut rates substantially, despite sticky core inflation, but looks set to remain on hold on September 23.

Its deputy governor says that latest figures show growth and inflation moving in the right direction.

A line chart comparing inflation metrics over the past five years.

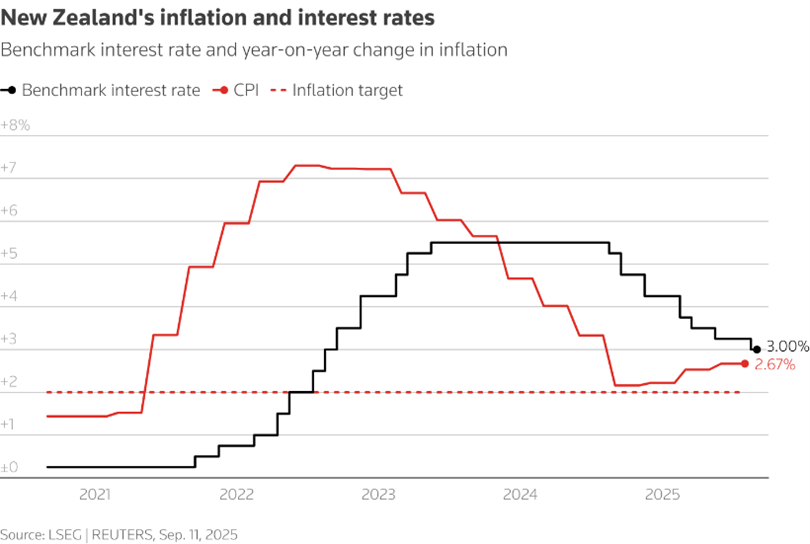

4/ NEW ZEALAND

Domestic and global growth headwinds could pave the way for the Reserve Bank of New Zealand to cut rates in October and probably once more by year-end, a Reuters poll of economists shows.

The RBNZ cut its policy rate by 25 bps to a three-year low of 3% last month.

A line chart comparing inflation metrics over the past five years.

5/ EURO ZONE

The ECB held its key rate at 2% on Thursday and said that it now sees inflation at 1.9% in 2027, below the 2% target.

Markets think it is possible the ECB could cut rates again, putting the chances of that happening by mid-2026 at around 50%.

The ECB halved its the rate to 2% in the year to June but has been on hold ever since, saying the euro zone economy is in a "good place".

A line chart comparing inflation metrics over the past five years.

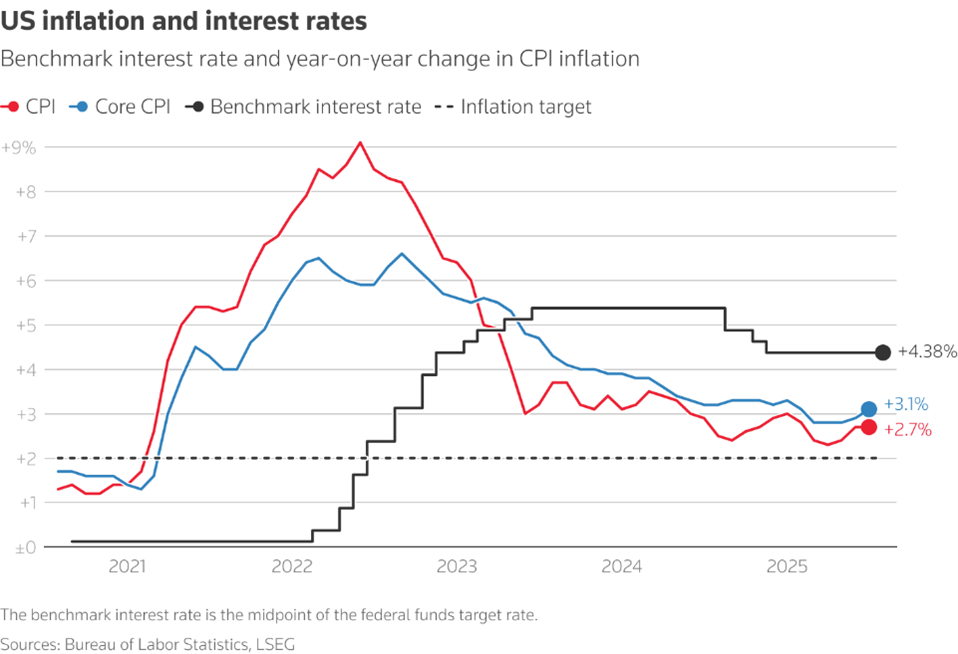

6/ UNITED STATES

The Fed looks set to cut rates by 25 bps next week, having been on hold all year on concerns about the inflationary impact of tariffs.

It's Thursday, September 11, and here's what you need to know.

Weakening jobs data means a rate cut is now fully baked in and some banks do not rule out a bigger 50 bp cut. In total, nearly 70 bps of cuts are priced in by year-end.

President Donald Trump has repeatedly urged the Fed to cut rates more. Investors are also watching the fate of Fed governor Lisa Cook whom Trump has moved to fire. A federal judge on Tuesday temporarily blocked this.

A line chart comparing inflation metrics over the past five years.

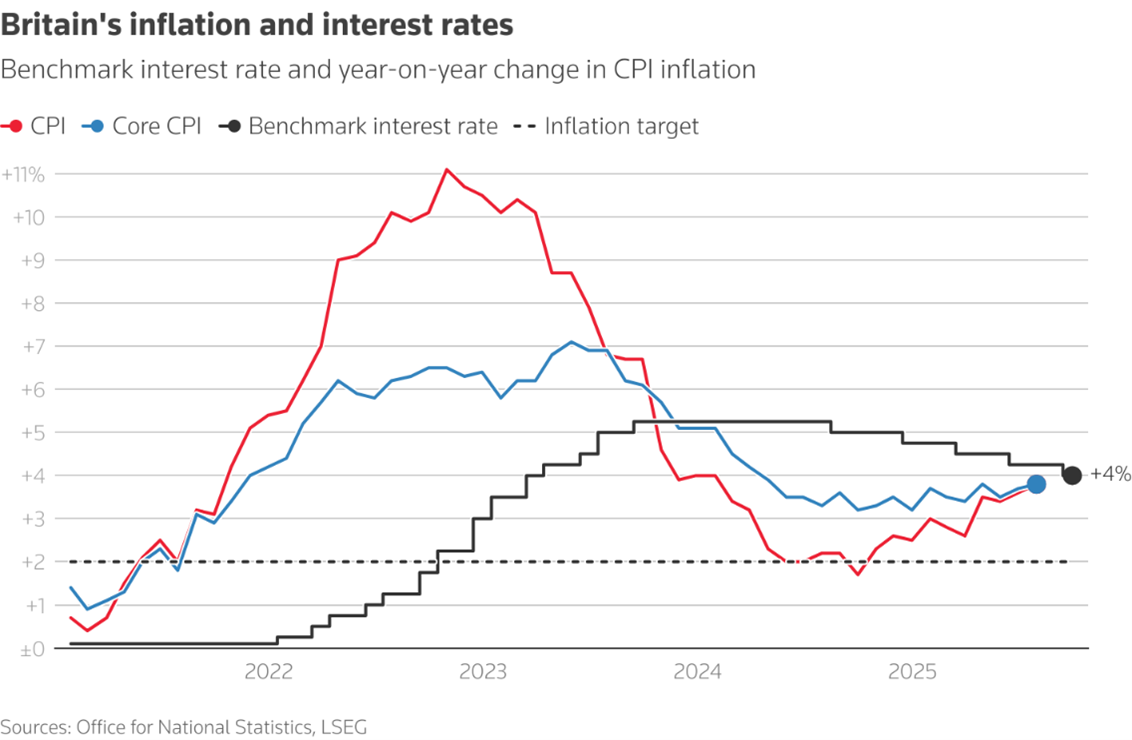

7/ BRITAIN

The Bank of England meets next Thursday and traders see no change to borrowing costs or any further easing this year.

Analysts have also pushed back BOE rate-cut expectations, citing stubborn inflation, the highest among the Group of Seven advanced economies.

The BoE cut rates by 25 bps in August, its fifth move this cycle.

A line chart comparing inflation metrics over the past five years.

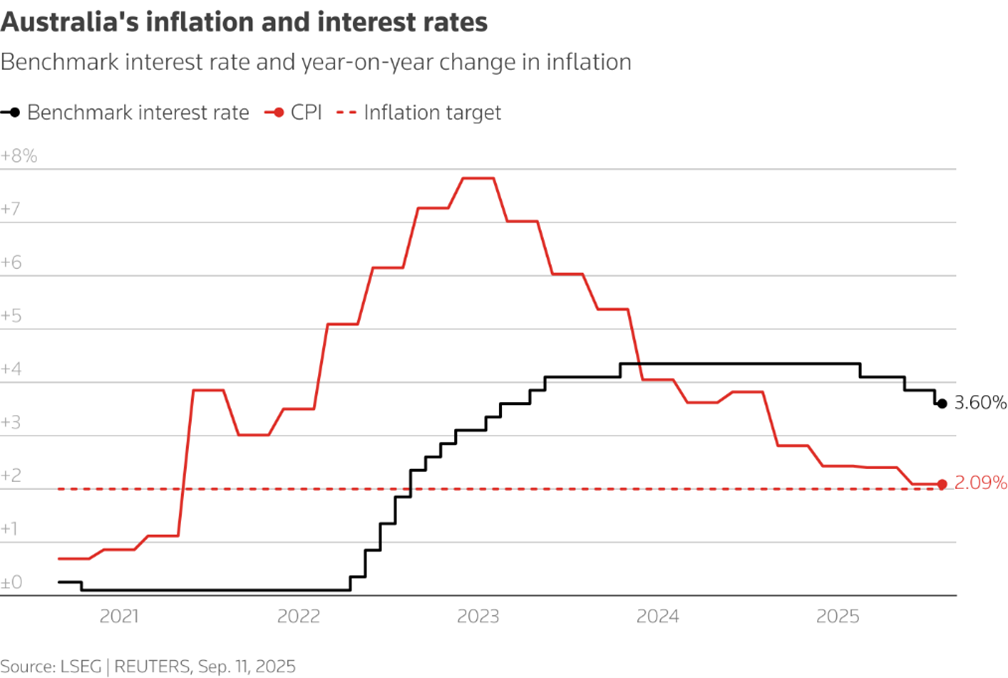

8/ AUSTRALIA

The Reserve Bank of Australia has cut rates by 75 bps since February, though strong second-quarter GDP data means markets have pared back bets on more easing.

Traders price in one more 25 bp cut this year, and another in early 2026.

A line chart comparing inflation metrics over the past five years.

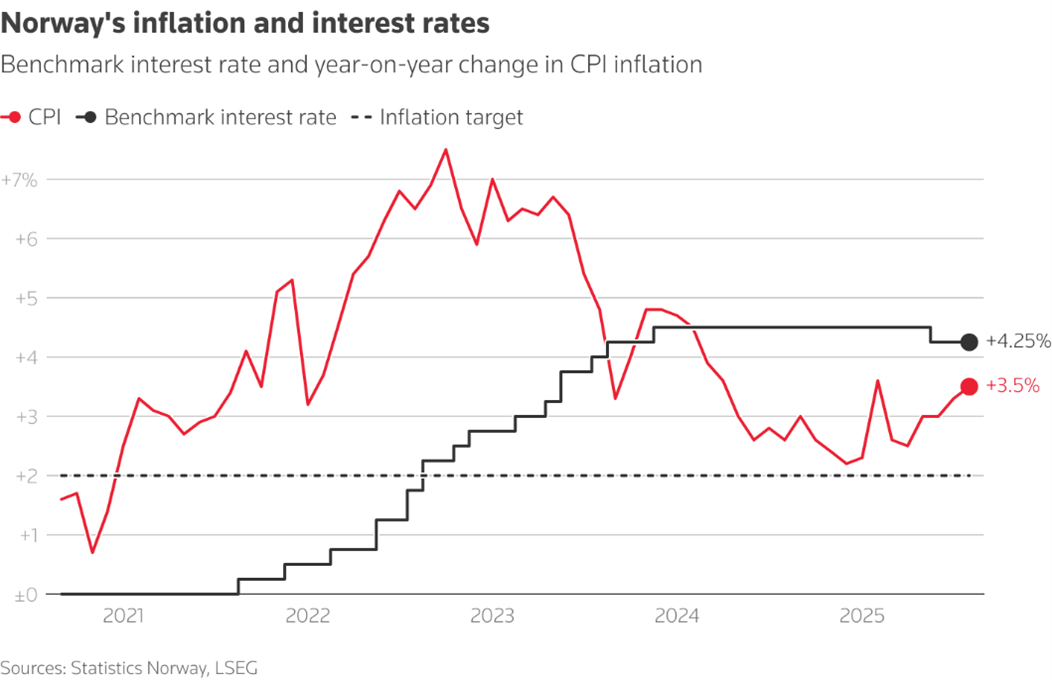

9/ NORWAY

Norges Bank has made just one 25 bp rate cut this cycle. Markets see one more cut this year, most likely next week, though hot underlying inflation data on Wednesday has called this into question.

A line chart comparing inflation metrics over the past five years.

10/ JAPAN

The Bank of Japan, the sole major central bank in tightening mode, has had its task complicated by Prime Minister Shigeru Ishiba's resignation.

The uncertainty leaves the central bank almost certain to hold rates next week, and makes an October hike harder, though they could still squeeze one in by year-end.

Also watch next week whether the BOJ reduces its purchases of super-long-dated government bonds.